Impact

Transform how you support students

Peach helps financial aid teams save time, respond faster, and support students more effectively.

Peach streamlines financial aid office communications with centralized ticketing and AI-powered responses.

.svg)

Impact

Peach helps financial aid teams save time, respond faster, and support students more effectively.

Features

Peach's AI-powered features reduce manual tasks, boost response times, and maximize team capacity.

All student interactions tracked in one place with full history.

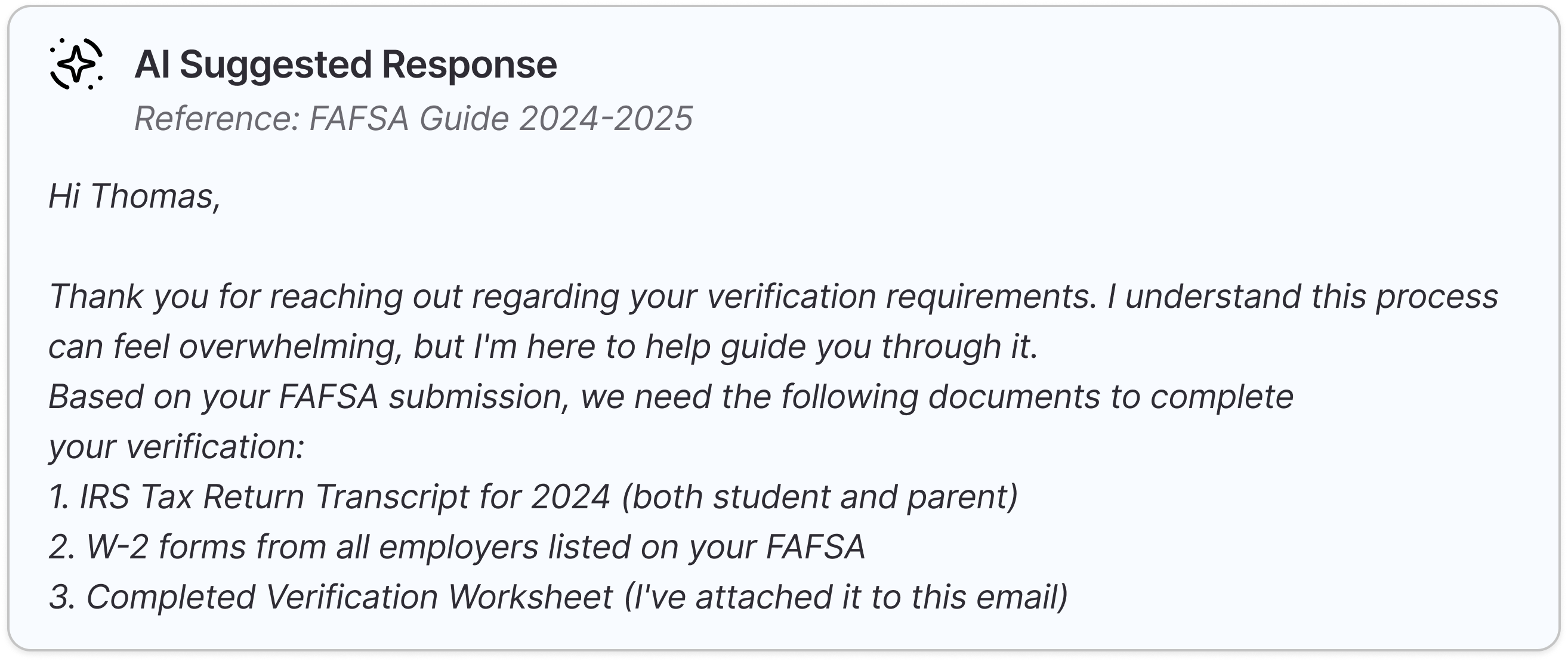

Policy-aligned replies drafted instantly for staff to review and send.

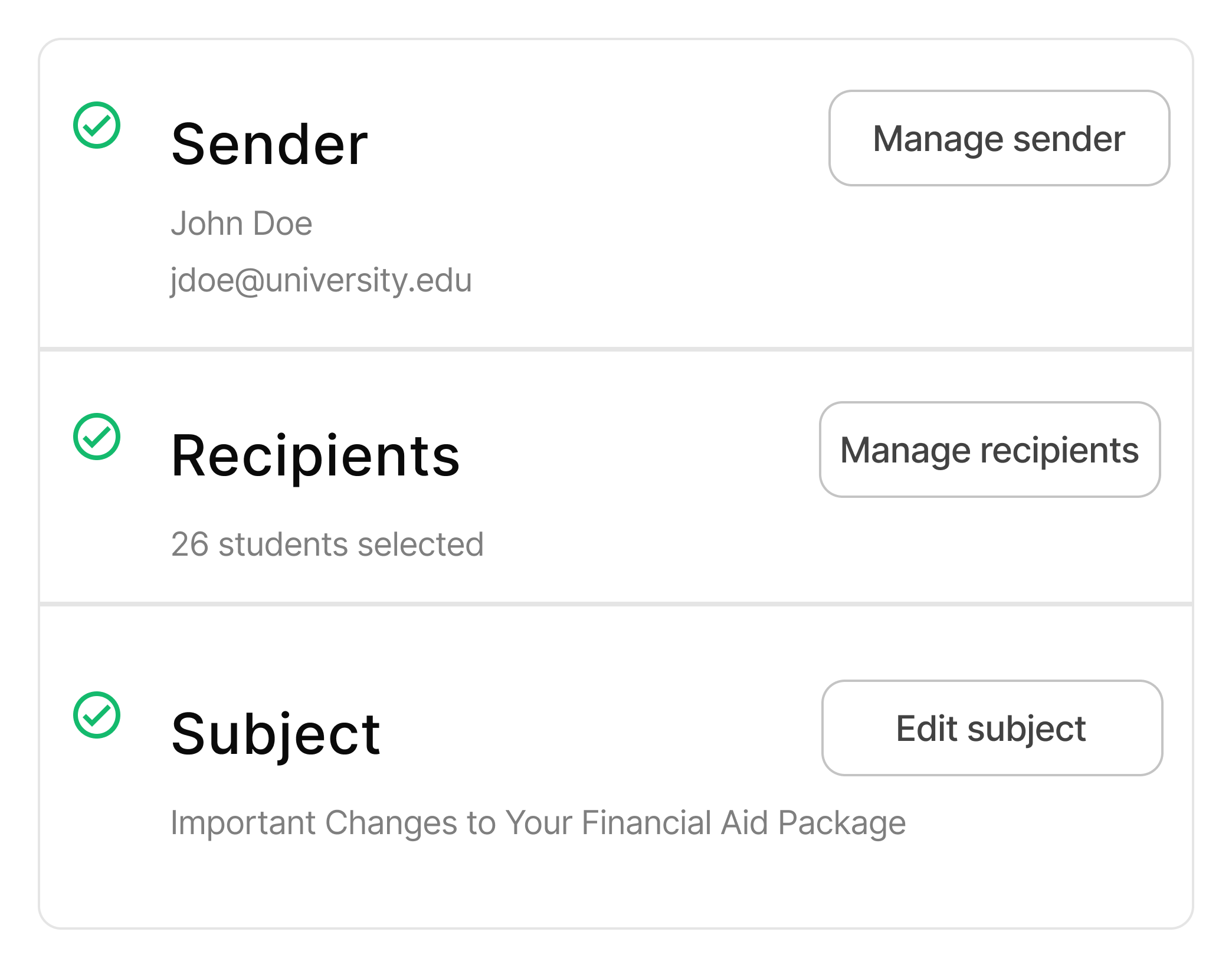

Send targeted student campaigns with AI-personalized messages.

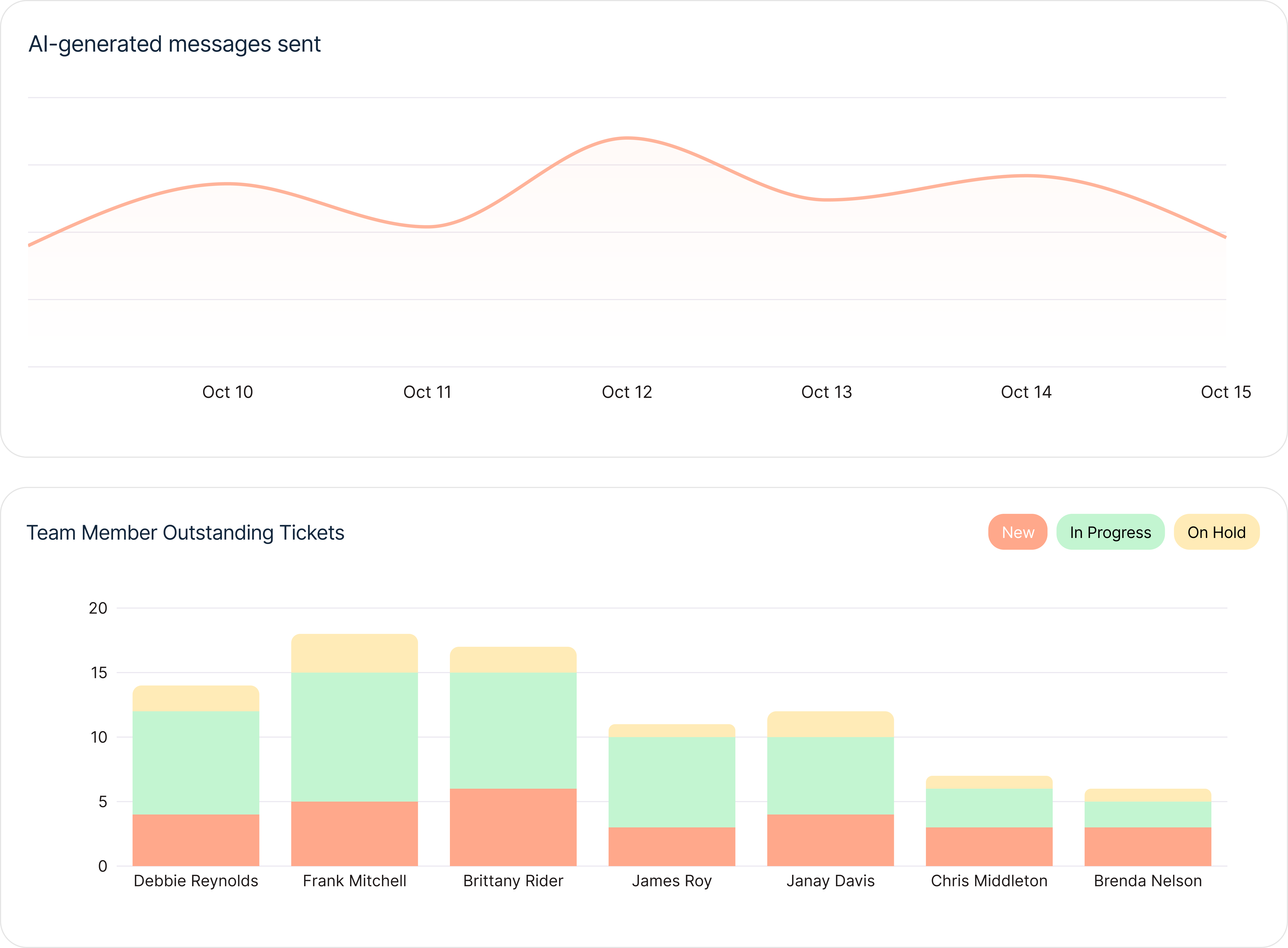

Real-time analytics into response times and volume trends.

Security

Peach integrates with your systems, aligns with FERPA, and provides secure audit logging.

AI Assistant

Peach's AI assistant delivers immediate, regulation-backed

guidance for even the most complex student scenarios.

FAQs

Have questions about Peach? Here are some of the most common queries to help you get started.

Can’t find the answer you’re looking for? Please connect with our friendly team!